The UAW rejects that argument. It contends that the layoffs are unjustified and were imposed as part of the companies’ pressure campaign to persuade UAW members to accept less favorable terms in negotiations with automakers. The factories that have been affected by layoffs are in six states: Michigan, Ohio, Illinois, Kansas, Indiana and New York.

Sam Fiorani, an analyst with AutoForecast Solutions, a consulting firm, said he thinks the layoffs reflect a simple reality: The automakers are losing money because of the strikes. By slowing or idling factories that are running below their capacities because of strike-related parts shortages, Fiorani said, the companies can mitigate further losses.

“It doesn’t make sense to keep running at 30% or 40% of capacity when it normally runs at 100%,” he said. “We’re not looking at huge numbers of workers relative to the ones actually being struck. But there is fallout.”

In a statement, Bryce Currie, vice president of Americas manufacturing at Ford, said: “While we are doing what we can to avoid layoffs, we have no choice but to reduce production of parts that would be destined for a plant that is on strike.”

UAW President Shawn Fain countered in a statement that the automakers were using layoffs to pressure the union into settling the strike. With billions in profits, Fain argued, the companies don’t have to lay off a single employee.

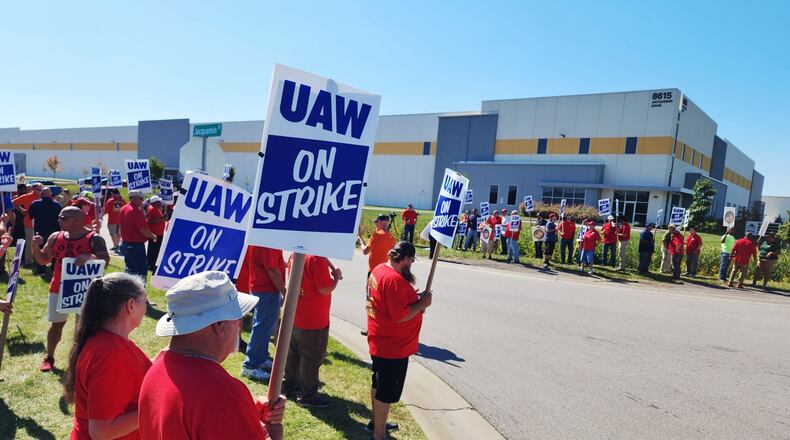

The UAW began striking against General Motors, Ford and Stellantis on Sept. 15, with one assembly plant from each company. The next week, the union expanded the strike to 38 GM and Stellantis parts warehouses. Assembly plants from Ford and GM were added the week after that. All told, about 25,000 workers have walked off their jobs at the three automakers.

Striking workers are receiving $500 a week from the union’s strike pay fund. By contrast, anyone who is laid off would qualify for state unemployment aid, which, depending on a variety of circumstances, could be less or more than $500 a week.

“Their plan won’t work,” Fain said. “The UAW will make sure any worker laid off in the Big Three’s latest attack will not go without an income.”

GM said it has laid off 2,330 workers, including 1,600 at a temporarily closed assembly plant in Kansas City, Kansas, that makes the Chevrolet Malibu sedan and Cadillac XT4 small SUV. The plant uses metal parts produced at the GM plant in Wentzville, Missouri, which is on strike.

Other GM facilities that have been affected by layoffs are in Lockport, New York; Toledo, Ohio; Marion, Indiana; Parma, Ohio; and Lansing, Michigan.

Ford said it has laid off 1,865 workers. They include 600 auto-body and parts-stamping employees in Wayne, Michigan, who are not on strike but who have been affected by a nearby assembly plant that has been struck. Other Ford locations with layoffs include Chicago; Sterling Heights and Livonia, Michigan; and Cleveland and Lima, Ohio.

Stellantis said late Monday that it had laid off about 640 workers, including 520 at an engine factory complex in Trenton, Michigan, that supplies a Jeep plant in Toledo, Ohio, that is on strike. Other locations with layoffs include a metal casting plant in Kokomo, Indiana, and a machining factory in Toledo.

Fiorani said that if the strike widens, more workers will likely be laid off at non-striking plants. Once metal stamping factories that supply multiple assembly plants have produced enough parts for non-striking facilities, the companies would likely shut them down.

“Once you’ve filled up the stocks for the other plants you supply,” he said, “you have to lay off the workers and wait out the strike.”

Separate companies that manufacture parts for the automakers are likely to have laid off workers but might not report them publicly, said Patrick Anderson, CEO of the Anderson Economic Group in Lansing, Michigan.

A survey of parts supply companies by a trade association called MEMA Original Equipment Suppliers found that 30% of members have laid off workers and that more than 60% expect to start layoffs in mid-October.

Fiorani said that while larger parts suppliers can likely withstand the strike, smaller companies that make parts for the bigger companies might not have enough cash or the ability to borrow to outlast the job actions. Some, he said, may have a couple dozen workers “and don’t have billions in value to use as collateral in loans,” he said.

Thus far, the union has decided to target a small number of plants from each company rather than have all 146,000 UAW members at the automakers go on strike at the same time.

Last week, the union reported progress in the talks and decided not to add any more plants. This came after GM agreed to bring joint-venture electric vehicle battery factories into the national master contract, almost assuring that the plants will be unionized.

Battery plants are a major point of contention in the negotiations. The UAW wants those plants to be unionized to assure jobs and top wages for workers who will be displaced by the industry’s ongoing transition to electric vehicles.

About the Author