If the village is dissolved by passage of Issue 10, it will be absorbed into Massie Township, officials said.

“We don’t want to dissolve,” Harveysburg Mayor Jonathan Funk said. “... There were several complaints and I think we’ve resolved most of those complaints.”

Those who have circulated petitions to get Issue 10 on the ballot “have actually gone out with some of our people in the village and talked to people about not surrendering corporate powers,” Funk said.

Gary and Lynn Hatfield, and Terri L. Smith were designated as a committee to pass the petitions, board of elections records show. Several attempts to reach the Hatfields and Smith for this report were unsuccessful.

After the petitions were filed, Funk said he talked with Gary Hatfield about withdrawing the ballot issue. But the deadline to remove them had passed.

Warren County Board of Elections Director Brian Sleeth said he talked with Funk and others about withdrawing them, but never talked to the Hatfields or Smith about the issue.

Funk said recently that there had not been conversations with Massie Twp. yet about the possibility of the village dissolving.

If an Ohio village’s residents vote to dissolve, a supervisory board is responsible for managing the transition, according to state law.

The board has three voting members — the county auditor, the county recorder, and one county commissioner — and a nonvoting township representative from each township affected by the dissolution.

The board appoints and supervises a receiver-trustee to assist the with “winding up the dissolved village’s affairs,” according to Ohio law.

Among the receiver-trustee’s duties: Resolve the outstanding debts, obligations, and liabilities; approve necessary operations and budgetary functions; settle or resolve any legal claims against the village; and administer and collect taxes and special assessments levied by the dissolved village.

The corporate power question is one of six total ballot issues facing Harveysburg voters. The Harveysburg ballot also includes Issue 8, a village property tax levy for regular operating expenses, and Issue 9, a tax levy for police services. Both levies were rejected by voters last year.

The other three — the citizen petition-led Issues 11-13 — are related. They involve repealing an admissions tax and repealing building inspection fees, as well as refunds to those who paid the building fees, according to board of election records.

The village continues to examine what will occur if one or two of those measures are approved while one or two are rejected, said Chase Kirby, Harveysburg’s legal counsel.

However, if Issue 10 — dissolving the township — fails and Issue 11, which involves building fees being refunded, is approved, “there almost certainly would be a lawsuit” filed by the village, Kirby said.

If residents vote to dissolve the township, “then all the other issues essentially become moot,” he added.

After levy defeats in November 2023, Harveysburg’s council approved a 3% admissions tax on event ticket sales in the village, which includes the Ohio Renaissance Festival and the thousands of visitors it attracts annually.

Issue 8 is a 3-mill additional, five-year property tax levy. It would generate about $50,060 annually, costing the owner of a home valued at $100,000 about $105 a year.

Issue 9 is a 2.5-mill additional, five-year police levy It would generate about $41,710 annually, costing the owner of a home valued at $100,000 about $88 a year.

Property tax levies are “the basis of the whole village on their funding,” Harveysburg Council President Jim Nelson said. “There’s very little sales tax that comes in.”

The village gets money from the county from a $5 license tax, but levies generally “sustain the whole village,” Nelson said.

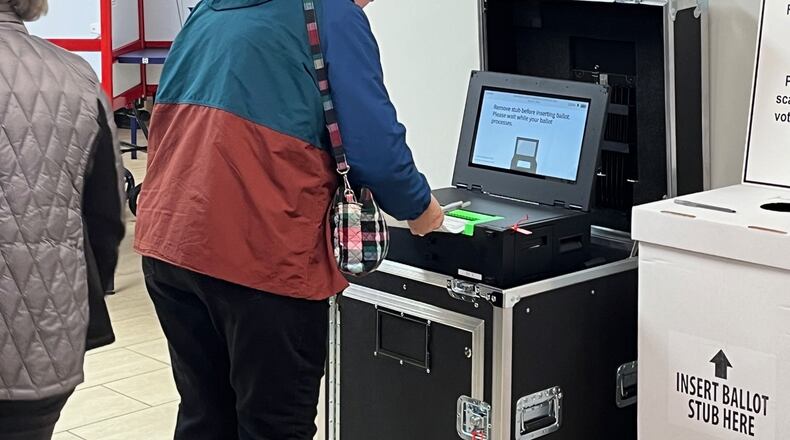

Credit: Tom Gilliam

Credit: Tom Gilliam

If the levies are rejected again Nov. 5, the loss in tax revenue will be supplemented by money collected through a new agreement with the Renaissance Festival, Funk said. The 10-year deal provides Harveysburg with a minimum of $100,000 a year, “but that goes away if we dissolve,” Funk said.

“With that injection of the minimum of $100,000, that’s really going to help us maintain. But we just don’t want to maintain,” Funk said. “We want to improve our roads and services for the community. It’s been lacking for a long time.”

Other than Harveysburg

Across the county, a total of 24 local tax levies and other ballot questions will appear from jurisdiction to jurisdiction. They range from school district, fire and library tax levies to one marijuana ordinance and nine Sunday liquor sale issues. In northern Warren County, they include:

• Carlisle: Giving the city authority to aggregate electric and gas loads in an attempt to find lower rates;

• Lebanon: An ordinance to remove the penalties for marijuana offenses and allow medical marijuana dispensaries to dispense adult-use marijuana;

• Wayne Twp.: a five-year, 2-mill additional fire service levy that would cost a homeowner $70 annually per $100,000 of property value;

* Liquor option votes for Lebanon Brewing and Mi Cozumel in Lebanon, Heathers in Springboro, and Waynesville BP.

About the Author